Individual Pension Plan Cra

This is a type of defined benefit pension plan governed by provincial pension legislation. The letters appear to be connected to an ongoing audit program targeting IPPs.

Key011 Individual Pension Plans Why They Are Mindmeister Mind Map

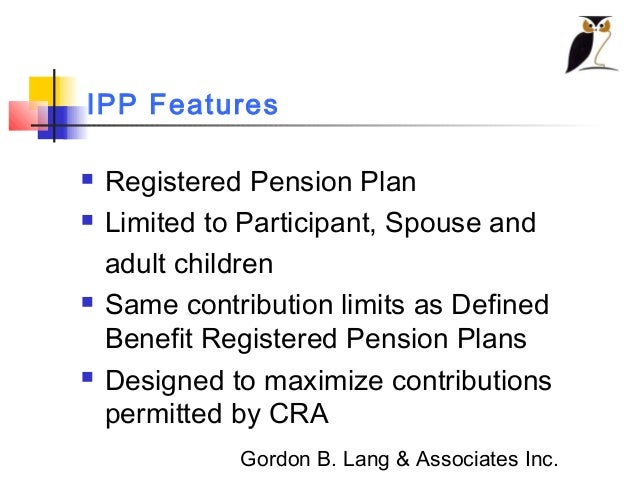

Each IPP must qualify for registration as a pension plan under the Income Tax Act.

Individual pension plan cra. An IPP is a registered defined benefit pension plan for designated individuals. A defined benefit pension plan provides a lifetime retirement benefits starting at a certain age. Top HTML Content.

All pension related calculations are performed by an accredited. It works like a defined benefit plan and must follow Canadas pension plan rules. An IPP is a registered defined-benefit DB pension plan typically set up for just one member you.

Consider Group RRSPs pension funds and Voluntary Retirement Savings Plans VRSPs for example. Older is better for anyone setting up an individual pension plan IPP. Disadvantages of Individual Pension Plan.

Or is a designated plan and it is reasonable to conclude that the rights of one or more members to receive benefits under the plan exist mainly to avoid the first condition. Complexity An IPP has annual filing requirements with CRA and fiduciary responsibilities on trustees. Both types of plans are likely to be put in place for executives or persons.

Accumulate over 75 more in your registered tax-deferred retirement savings fund with an Individual Pension Plan. The corporate set up is imperative as non-incorporated organizations such as partnerships and sole-proprietors would not be eligible for an individual pension plan in Canada. IPPs are beneficial for high income typically over 100000 owners of.

Are you eligible for an Individual Pension Plan. An Individual Pension Plan IPP is a defined benefit pension plan for the benefit of one or two individuals. The YMPE for 2020 is 58700.

An individual pension plan is a retirement vehicle commonly set up for owners of private corporations. There is no legislation in the Income Tax Act ITA that refers to a Personal Pension Plan. What is an Individual Pension Plan IPP.

These plans are registered with the Canada Revenue Agency CRA and covered under the Income Tax Act. If the spouse is employed by the same company or a related company the spouse andor children may be added to the plan. CRA Challenging Individual Pension Plans IPPs The Canada Revenue Agency CRA has recently mailed detailed audit request letters to members of certain individual pension plans IPPs.

Has less than four members and at least one of them is related to a participating employer. An individual pension plan IPP can help you shelter more income than an RRSP but only if you earn more than 100000 per year and as an ownermanager are prepared to commit your company to meeting all obligations associated with IPPs. Complexity- An IPP has annual filing requirements with CRA and fiduciary responsibilities on trustees.

Read full definition. An individual pension plan IPP is a registered pension plan that has a defined benefit provision and. What is an Individual Pension Plan IPP.

The ideal candidate for an IPP is an individual who. It can let you build your retirement income under a tax-sheltering umbrella. Complexity- An IPP has annual filing requirements with CRA and fiduciary responsibilities on trustees.

Ontario Regulation 17812 made under the Pension Benefits Act the PBA Regulation includes a definition for individual pension plan IPP. As background an IPP is a defined benefit pension plan typically established for one person. At least one of them must be related to a participating employer.

What is an Individual Pension Plan IPP. How do individual pension plans work. IPPs are pension plans typically designed for one person although family members can also participate if they work in the business.

An IPP is designed to provide asset diversification increased retirement savings when compared to a registered retirement savings plan RRSP significant corporate tax deductions from contributions tax deferral and creditor protection. Benefits of Individual Pension Plan. What is an Individual Pension Plan IPP.

It is important to note the Defined Benefit DB component of the Personal Pension Plan which is in most cases the only component of the Personal Pension Plan that is utilized is ultimately an IPP and it is therefore registered as such with CRA. Inflexible- No access to the funds while the business owner. An Individual Pension Plan IPP is a defined benefit Pension Plan that is registered with the federal and provincial governments and will allow you to accumulate and make significant contributions to your personal retirement fund above and beyond what is possible with a standard RRSP.

Costs- An IPP is considerably more costly to establish and administer than RRSPs they require setup annual and tri-ennial valuation fees. Employer contributions are tax deductible. There are significant advantages that Individual Pension Plans have over Registered Retirement Plans RRSPs.

Disadvantages of Individual Pension Plan. Is at least 45 years old an. Disadvantages of Individual Pension Plan Costs- An IPP is considerably more costly to establish and administer than RRSPs they require setup annual and tri-ennial valuation fees.

Individual Pension Plans IPPs Income Tax Regulations s. Individual pension plan Régime de retraite individuel For a calendar year an individual pension plan IPP is a registered pension plan that has a defined benefit provision if at any time in the year or a preceding year the plan has fewer than four members and at least one of the them is related to a participating employer in the plan. Individual pension plan IPP A retirement savings plan that allows bigger tax-deductible contributions than an RRSP.

For other situations however a Group Retirement Plan may be better suited to certain needs. The Individual Pension Plan is an advantageous retirement option for business owners and executives. Individual Pension Plans would then be opened with your plan provider and be registered with the CRA who determines the maximum limit that account holders can withdraw in retirement on a given year.

The treatment of such plans under the Pension Benefits Act PBA will be similar to that of designated plans. An IPP allows a business owner to increase their retirement savings and establish long-term financial security through considerable tax-deductible contributions. What is an individual pension plan and how does it work.

It is designed for people with higher incomes. And you can get. Costs- An IPP is considerably more costly to establish and administer than RRSPs they require setup annual and tri-ennial valuation fees.

An Individual Pension Plan IPP is a defined benefit pension plan designed for business owners of incorporated companies. Lets now look at some more information regarding how individual pension plans work. Incorporated professional or key employee an Individual Pension Plan IPP may be a possible solution.

Essentially an IPP in Canada serves two roles. Per the CRA individual pension plans must have fewer than four members.

Transferring A Commuted Value To An Individual Pension Plan Advisor S Edge

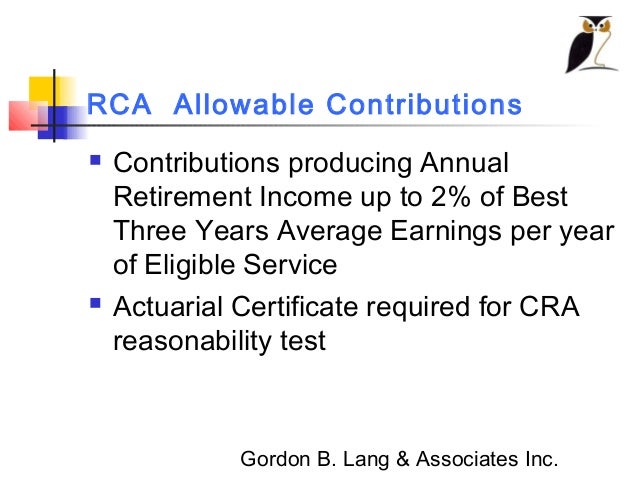

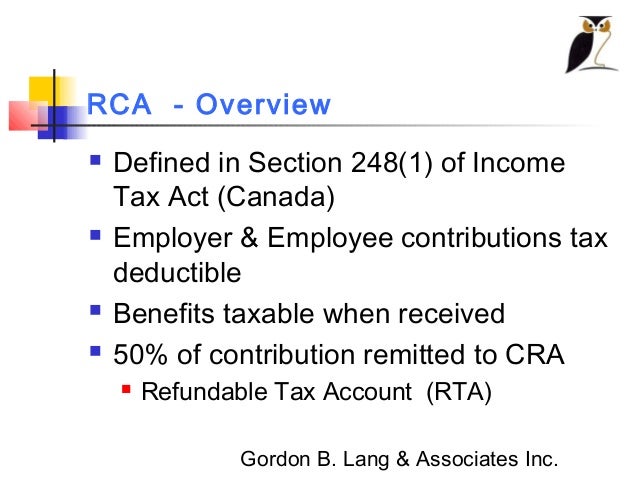

Gordon B Lang The Truths And Myths Of Retirement Compensation Arran

Cra Employee Or Self Employed Canadian Group Insurance Brokers

Individual Pension Plans For Incorporated Professionals British Columbia Medical Journal

Fillable Online Individual Pension Plans Ipp Fax Email Print Pdffiller

Personal Pension Plans For Veterinarian Life Care Insurance

Individual Pension Plans You Down With Ipp Shajani Llp Chartered Professional Accountants Advisors

![]()

Individual Pension Plans For Health Care Professionals Divisions Of Family Practice

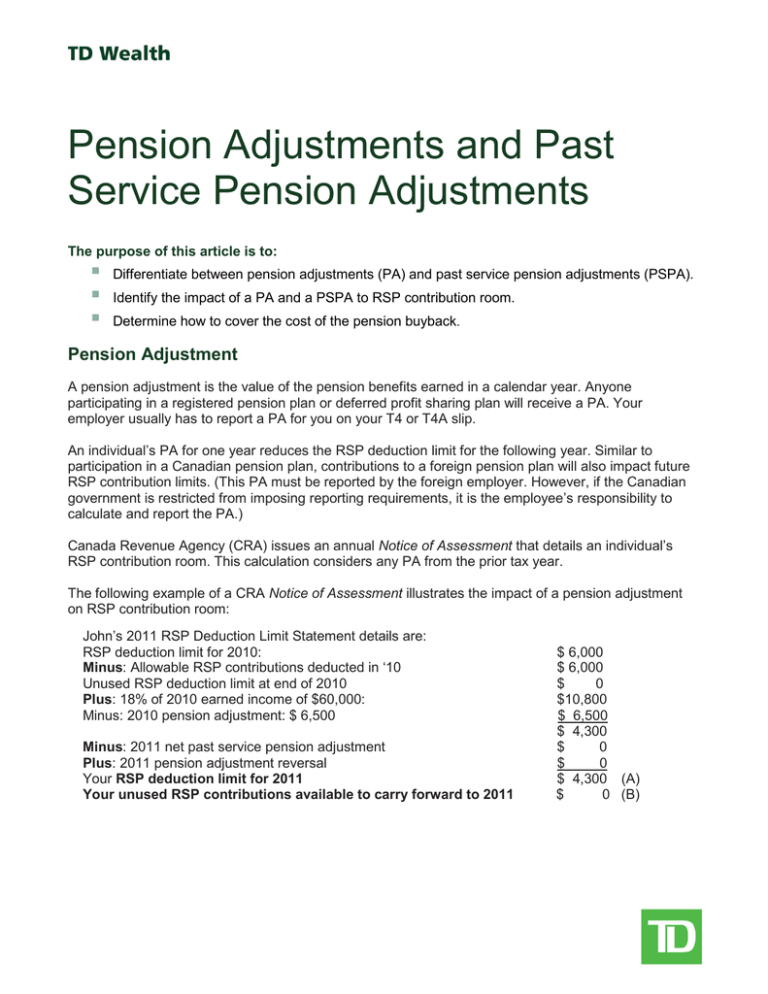

Pension Adjustments And Past Service Pension Adjustments

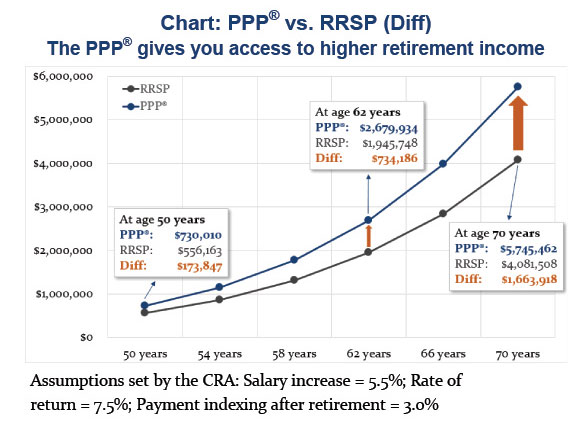

Altruistic Wealth Management Individual Pension Plans Ipp And Personal Pension Plans Ppp

Understanding The Ins Outs Of An Individual Pension Plan Ipp

Gordon B Lang The Truths And Myths Of Retirement Compensation Arran

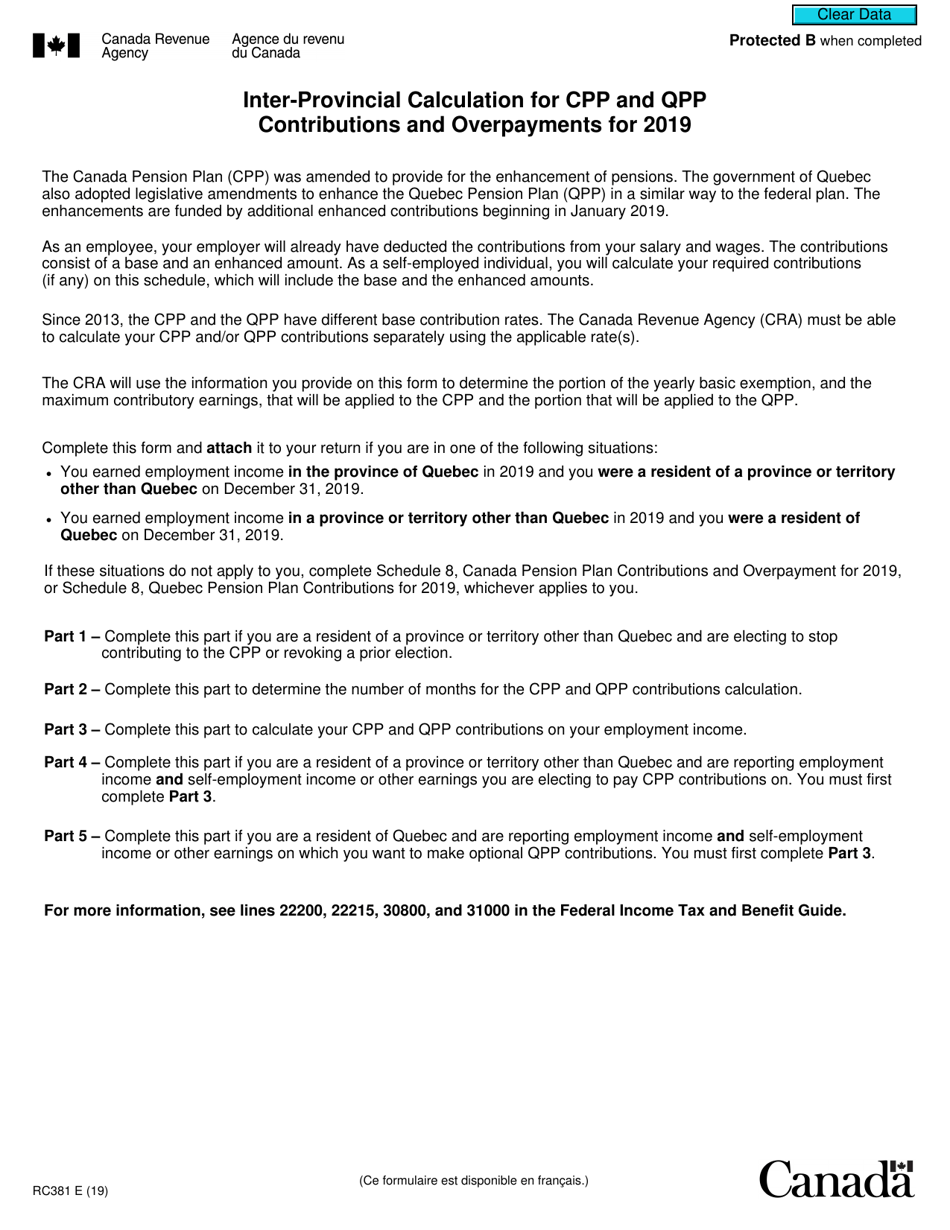

Form Rc381 Download Fillable Pdf Or Fill Online Inter Provincial Calculation For Cpp And Qpp Contributions And Overpayments 2019 Canada Templateroller

The Individual Pension Plan Getting Out Benefits And Pensions Monitor

Gordon B Lang The Truths And Myths Of Retirement Compensation Arran

Post a Comment for "Individual Pension Plan Cra"