Lincoln Financial Roth Ira

You must be at least age 59½ and have held money in a Roth account for at least five years to receive tax-free withdrawals of any earnings or interest on your contributions. 1 The value of the account after you pay income taxes on all earnings and tax-deductible contributions and 2 additional earnings from the re-invested tax savings.

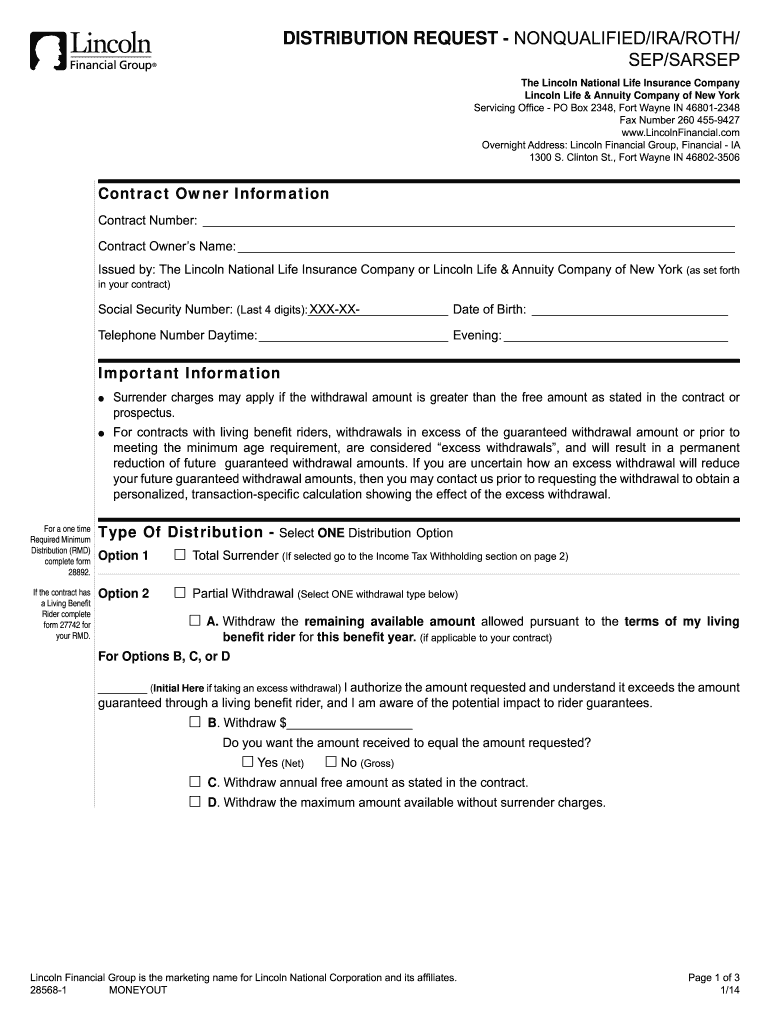

Printable Lincoln Financial Distribution Form Fill Online Printable Fillable Blank Pdffiller

Tax-free withdrawals Income limit for 2021 contributions.

Lincoln financial roth ira. LFA a broker-dealer member FINRA and an affiliate of Lincoln Financial Group 1300 S. Deduction phases out for adjusted gross incomes between 105000 and 125000 married filing jointly or between 66000 and 76000 single filer 4 Eligibility phases out for adjusted gross incomes between 198000 and 208000 married filing. The IRA owns shares in a company also referred to as protocol shares It works like a standard IRA only it holds bullion bars or coins instead of holding paper.

You can choose to direct your entire annual contribution to a Roth 403b or split your annual contribution between a Roth 403b and a Traditional 403b account in any manner you choose. It is important to note that this is the maximum total contributed to all of your IRA accounts. Traditional IRA Roth IRA.

The amount you will contribute to your Roth IRA each year. Roth IRA contributions cannot be made by taxpayers with high incomes. The IRA owns shares in a company also referred to as protocol shares It works like a standard IRA only it holds bullion bars or coins instead of holding paper investments.

17 2021 at 914 am. In 1997 the Roth IRA was introduced. To qualify for the tax-free and penalty-free withdrawal of earnings Roth IRA distributions must meet a five-year holding requirement and occur after age 59½.

However the rules governing conversions to a Roth IRA are complex and should be discussed with your Lincoln financial professional. For the traditional IRA this is the sum of two parts. The acquisition was financed with cash and issuance of debt.

Lincoln Financial Group said it has struck an agreement with Talcott Resolution Life Insurance Co. This new IRA allowed for contributions to be made on an after-tax basis and all gains or growth to be distributed completely tax-free. For the Roth IRA this is the total value of the account.

In addition to contribution and distribution rules there are limits on how much can be contributed each year to either IRA. You are over the age of 59 12 the funds up to 10000 are used for the purchase of a first home or the withdrawal is due to. For 2021 contributions to a Roth IRA are phased out between 198000 and 208000 for married couples filing jointly and between 125000 and 140000 for single filers.

You must meet certain income requirements to save in a Roth IRA and youre not required to start taking distributions at any age. Lincoln Financial Group is the marketing name for Lincoln National Corporation and insurance company affiliates including The Lincoln National Life Insurance Company Fort Wayne IN and in New York Lincoln Life Annuity Company of New York Syracuse NY. Lincoln Financial Roth Ira A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance.

Lincoln Financial Group is the marketing name for Lincoln National Corporation and insurance company affiliates including The Lincoln. A distribution is considered qualified if your Roth account has been established for at least five years and youre at least age 59½ or if the withdrawal is due to your death or total disability. This calculator assumes that you make your contribution at the beginning of each year.

Individuals may contribute up to 6000 in 2021 to a traditional IRA If you have both a traditional and Roth IRA your total contributions cannot exceed the contribution limit per person per tax year Individuals age 50 and older may increase their contributions by 1000 in 2021. Lincoln Financial stock rallies after 94 billion reinsurance agreement Published. LNC based in Radnor Penn announced its plans to acquire Liberty from Liberty Mutual Insurance Group in January.

To qualify for the tax-free and penalty-free withdrawal of earnings a Roth IRA must be in place for at least five tax years and the distribution must take place after age 59½ or due to death disability or a first-time home purchase up to a 10000 lifetime limit. However your total annual contribution to all 403b accounts Roth and Traditional cannot exceed the maximum annual contribution limits for the year in which they are made. Unaffiliated broker-dealers also may provide services to customers.

Roth Ira Lincoln Financial A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. Roth Ira Lincoln Financial Overview. Back to Retirement basics This material is provided by The Lincoln National Life Insurance Company Fort Wayne IN and in New York Lincoln Life Annuity Company of New York Syracuse NY and their applicable affiliates collectively referred to as.

Lincoln Financial Group has closed on its 33 billion acquisition of Liberty Life Assurance Co. The Lincoln Alliance program includes certain services provided by Lincoln Financial Advisors Corp. Tax-deductible contributions Tax-deferred growth.

The maximum annual IRA contribution of 5500 is unchanged for 2018. Since then people with incomes under 100000 have had the option to convert all or a portion of. In 2021 the income phaseout limit is 140000 for single filers 208000 for married filing jointly.

However they can be rolled into a Roth IRA which is not subject to RMDs during the owners lifetime. Prospectuses for any of the mutual funds in the Lincoln Alliance program are available at 800-234-3500. IRA total after taxes.

Clinton St Fort Wayne IN 46802. To reinsure up to 15 billion in sales of Lincolns. Similar concepts about the timing of tax savings apply to Roth and traditional IRAs.

Technically Roth 401ks if they remain with your company after your departure or retirement are subject to RMDs after age 70 12. Earnings can be taken out tax-free and penalty-free if a Roth IRA has been held for at least five years and you meet one of the following. Lincoln Financial Group is the marketing name for Lincoln National Corporation and insurance company affiliates including The Lincoln National Life Insurance Company Fort Wayne IN and in New York Lincoln Life Annuity Company of New York Syracuse NY.

Lincoln Annuity Distribution Request Form Fill Online Printable Fillable Blank Pdffiller

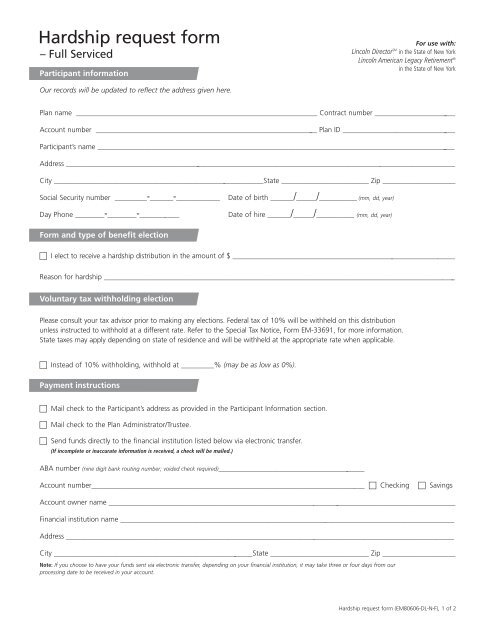

Hardship Request Form Welcome To Lincoln Financial Group

Help Dad S Retirement Account With Lincoln Financial Group Bogleheads Org

Lincoln Annuity New Directions 6 Annuity

Lincoln Distribution Request Form Fill Out And Sign Printable Pdf Template Signnow

Lincoln Financial Life Insurance Review 2021 Pros And Cons Nerdwallet

Hardship Request Form Welcome To Lincoln Financial Group

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Pin By Deborah Tulpa On Financial Planning In 2021 Roth Ira Financial Wellness Ira

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Lincoln Annuity Core Capital Annuity

Lincoln Annuity Optionblend 5 Annuity

Post a Comment for "Lincoln Financial Roth Ira"