Best Solo Roth 401k Providers

Find out which solo 401k provider is best for you. Answer 1 of 7.

Best 2021 Solo 401k Companies Compare The Top Providers

As your question in.

Best solo roth 401k providers. In the following well talk about all the options to look for in a Solo 401k provider including cost investment opportunities. Usually the key to selecting a solo 401k provider is to determine your needs. Vanguard Allows Roth contributions but no rollovers or 401k loans.

It offers 401 k plans payroll insurance human resources tax filing and other services. Both offer similar products but the service convenience and pricing are different. They allow both traditional and Roth contributions.

These fees can be waived for account holders who have at least 50000 in Vanguard accounts. There are no account maintenance fees or trading costs which is a big plus. If you want to buy Vanguard funds such as VTSAX just use Vanguard since they will be commission-free there.

Advisor services are available to help you select the suite. Vanguard is very straightforward with its Solo 401 k costs. Solo 401 k plans cost just 20 per year for each fund thats used in the plan.

My Solo 401k Financial provides a solo 401k plan that allows the business owner to process a solo 401k loan with a 30 year loan payback period if the borrowed proceeds are used toward the purchase of a primary residence. Here at IRA Financial we feel were the best Solo 401k provider and offer everything you could possibly need at a reasonable cost. Whereas IRA Financial Groups Solo.

Therefore when determining best Solo 401k plans you need to concentrate. As such I expected them to be a very low cost provider. Vanguard is one of the most popular solo 401k options because Vanguard has always been synonymous with low fees.

Fidelity Charles Schwab ETRADE and TD Ameritrade are all a. Vanguard has been said to be the best solo 401k provider. Fidelity Schwab Ameritrade etc.

ADP is another 401 k provider that offers combined services for small employers. You get to choose. There is a range of providers in the 401K market place.

20 annual fee for each different Vanguard fund in the account until you hold more than 50k with Vanguard very limited investment offerings. Whereas IRA Financial Groups Solo 401k Plan allows for in-plan Roth conversions. There are great options at Vanguard Fidelity Schwab and TD Ameritrade.

Roth IRA -- Vanguard Fidelity and Schwab all have free Roth IRAs. It is comparable to the difference in Wal-Mart and 7-11. There are nearly 20 companies offering individual or solo 401Ks.

I did a bunch of research before choosing TD Ameritrade. Vanguard is a wonderful company for just about everything except their i401k offering Fidelity No Roth. Best solo 401k plans Best Individual 401k Plans Best Solo 401k Providers.

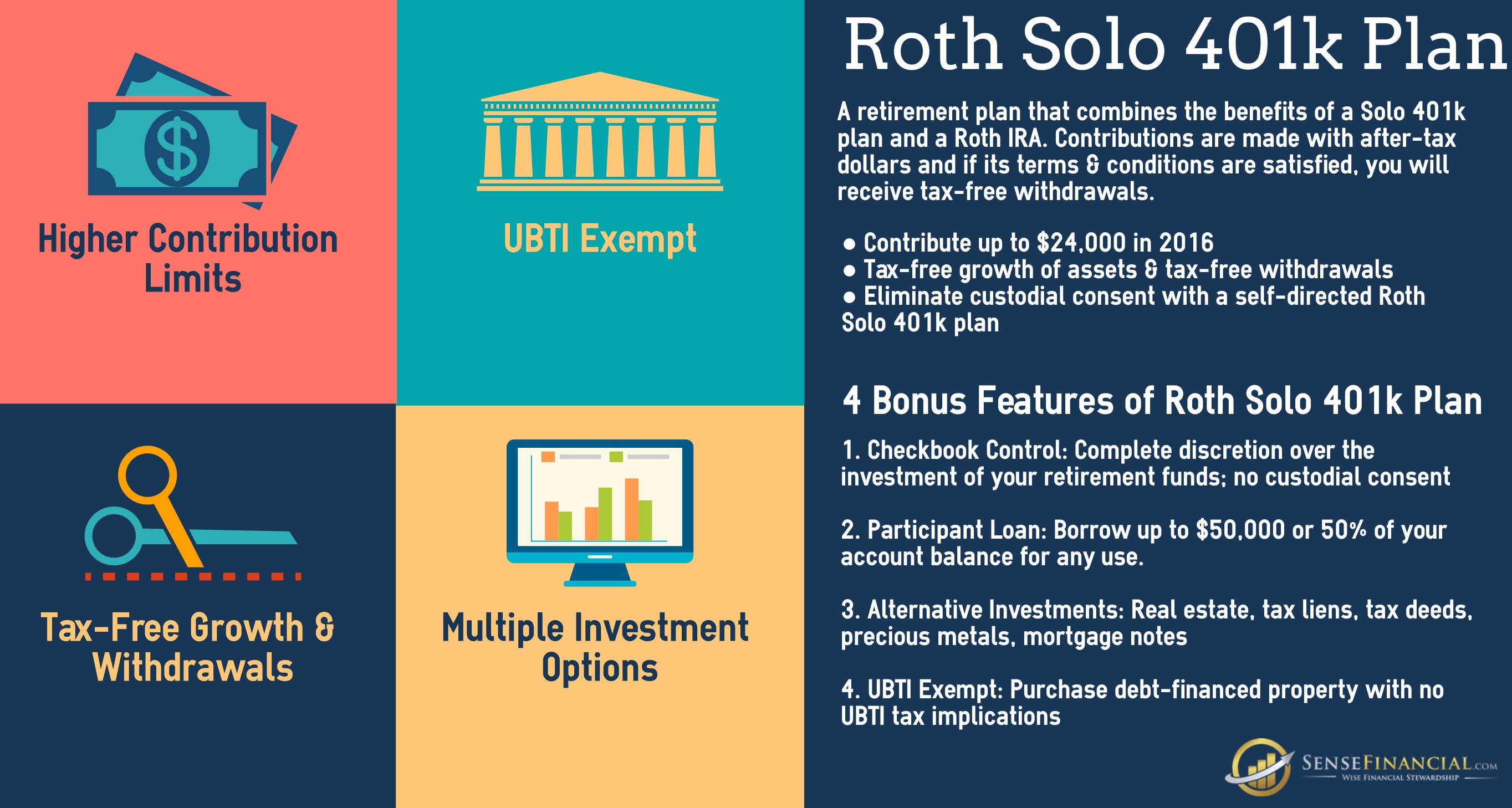

The three brokerages mentioned above all offer them. In addition most Solo 401k plan providers do not allow for in-plan Roth conversions or rollovers. A checkbook solo 401k from My Solo 401k Financial can be opened at your local bank or credit union or at Fidelity or Charles Schwab with checkbook control.

Since my contractor income is pretty small lets say like 40kyr my SEP contribution max would be 25 of that so 10k. It specializes in small companies with up to 49 plan members and offers several 401 k plans for businesses. TD Ameritrade TD Ameritrade offers one of the more flexible and cost effective plans on the market.

Vanguard does offer Traditional and Roth options for their solo 401k and they just started allowing rollovers of existing IRAs into the Solo 401k plan. If you are not interested in exotic things or maximum flexibility E-Trade is the best option. Best Solo 401k Providers.

Are good places to check. Solo 401k -- this is more complicated. Solo 401k Providers.

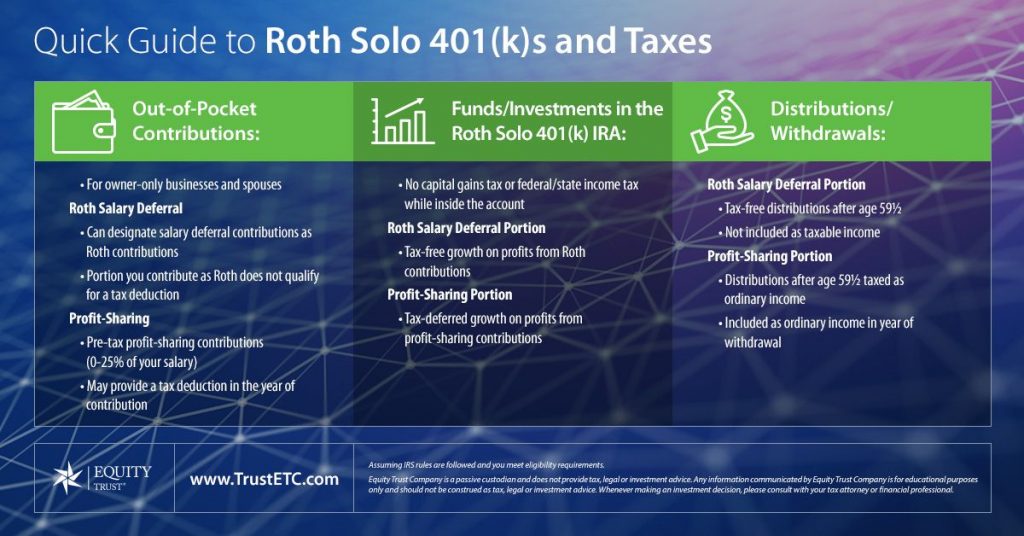

It is the only traditional brokerage that allows Roth contributions conversions to Roth rollovers of any kind into the account and loans from the account. However the Solo 401k Plan participant must pay income tax on the amount converted. From my experience with them they are also reasonably competent doing things electronically.

Choosing a solo 401k from any provider on this list could be a good fit for typical retirement savings and investment needs. Whereas the Solo 401k contribution limit is 19500 for employees and then additional employer matching on top of this. But it appears it is not the only company in its pedigree.

List of the top 25 401 k Providers in Shortlister as of October 2021 presented in the order they appear in the full Vendor Listing tab. Is there really such a thing as best Solo 401k PlansWell it depends on what you are looking for in your Solo 401k providerIn other words all Solo 401k plans are approved by the IRS through the issuance of an IRS determination letter. In addition most Solo 401k plan providers do not allow for in-plan Roth conversions or rollovers.

IRA Financial Groups Solo 401k Plan contains a built in Roth sub-account which can be contributed to without any income restrictions.

Good For You Good For Your Company 401 K Plans Were Created With Unique Advantages That Can Make A Real Difference In How To Plan Low Cost Business Business

Solo 401k Provider My Solo 401k Financial

Solo 401k Infographics Sense Financial Services Llc

Infographics 7 Retirement Savings Goals For 2017 Saving Goals Saving For Retirement Retirement Portfolio

Best Solo 401k Providers White Coat Investor

Self Directed Solo 401k Solo 401k Self Directed Ira

Self Directed Solo 401k Vs Self Directed Ira My Solo 401k Financial

Solo 401k My Solo 401k Financial

Solo 401k Contribution For Partnership And Compensation

4 Key Advantages To Having A Self Directed Solo 401 K Instead Of A Sep Ira

Solo 401k Contribution Limits For 2020 2021

Solo 401 K Everything You Need To Know About The 10x Retirement Account

Solo 401k Infographics Sense Financial Services Llc

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable Retirement 401k Chart Retirement Planning Finance Saving For Retirement

Open A Solo 401k Account My Solo 401k Financial

Self Employed A Solo 401 K Might Be A Good Option For You District Capital

Infographics Why Choosing A Roth Solo 401 K Plan Makes Sense

Roth Solo 401k Contributions My Solo 401k Financial

Post a Comment for "Best Solo Roth 401k Providers"